Homeowners insurance does cover garage doors in some circumstances. As a homeowner, you want to ensure you’re prepared should you need to repair or replace your garage door. Discover the ins and outs of when home insurance may cover garage door damage.

Understanding Home Insurance and Garage Door Coverage

Garage doors are sometimes covered by home insurance. Explore when you’ll typically be covered and situations where your insurer may not cover the damage.

What Is Typically Covered?

These are some of the common instances where you are likely covered:

- Damage from windstorms, hail and lightning strikes: You are typically covered against weather-related perils like lightning strikes, hail and wind. Even so, it is a good idea to invest in a garage door that can withstand heavy winds and extreme weather.

- Fire damage: If a fire breaks out in your garage or home and damages the garage door, your policy usually covers the repair or replacement costs. Damage from soot and smoke is included.

- Break-ins: Break-ins that damage your garage door are generally covered by insurers.

- Vehicle damage: If a vehicle accidentally damages your garage door, your policy often covers the repair costs. Auto insurance may come into play in some scenarios, which we’ll cover in greater depth below.

Exceptions and Exclusions

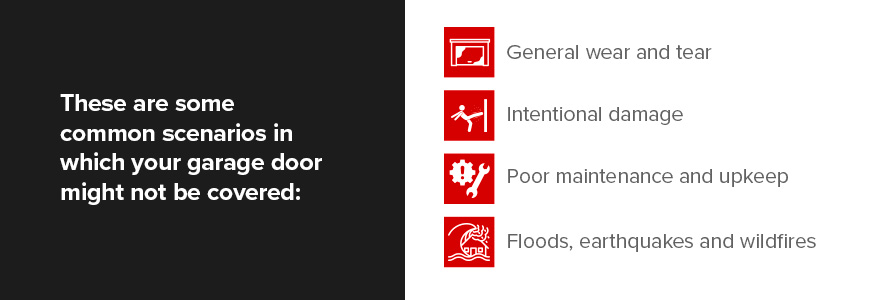

There are certain exceptions and exclusions to understand. Additionally, depending on how comprehensive your insurance is, specific damage may or may not be covered. These are some common scenarios in which your garage door might not be covered:

- General wear and tear: Damage caused by normal wear and tear is typically not covered by home insurance policies, and you will need to cover the repair expense.

- Intentional damage: If the insurer finds that the damage was caused intentionally by the homeowner or other residents, it is excluded from coverage.

- Poor maintenance and upkeep: If the damage is due to a lack of proper garage door maintenance and long-term neglect, your insurer will likely not cover the repairs.

- Floods, earthquakes and wildfires: Standard home insurance policies often exclude damage caused by certain natural disasters, such as floods, earthquakes and wildfires. You can usually add endorsements or separate policies to ensure you are covered in the event of such disasters.

A Closer Look at What Is and Isn’t Covered

Understanding the extent of your home insurance coverage is crucial. Explore some specific circumstances below.

Does Homeowners Insurance Cover Detached Garage Doors?

Detached garages often require separate coverage under an “other structures” policy because they are not attached to your home. Without one of these policies, damage to your detached garage might not be covered, and you would be responsible for covering the costs of repairs or full garage door replacement.

Attached garages are typically covered under your standard home insurance policy. However, you should always check your policy details to ensure you are adequately covered for either type of garage door.

Does Home Insurance Cover Garage Door Repairs?

While standard home insurance policies generally cover garage door repairs, the extent of coverage can vary significantly based on specific policy terms. Factors such as the type of damage, the cause and the policy’s coverage limits play crucial roles in determining how much the insurer will potentially pay out.

For instance, some policies may fully cover repairs and damage caused by falling trees or theft, while others might have exclusions or require higher deductibles. Additionally, certain policies might offer extra endorsements for enhanced protection.

It is essential to review your policy details and consult with your insurance provider to understand the exact terms and extent of your coverage.

Does Home Insurance Cover Garage Door Springs?

Home insurance generally covers garage door springs if the damage was due to a covered peril, such as fire or theft. However, damage from general wear and tear or poor maintenance is typically not covered. To be sure, check your policy’s specific details.

Does Car Insurance Cover Hitting a Garage Door?

If you accidentally hit your garage door with your car, your homeowners insurance policy will typically cover the damage done to the door. If you have collision coverage, you can likely use it to cover the damage to your vehicle. However, in some circumstances, auto insurance can cover damage to garage doors. For example, if someone else’s vehicle hits your garage door, their liability car insurance should cover the damage.

Filing a Claim for Garage Door Damage

Knowing how to file a claim streamlines and quickens the repair process when your garage door sustains damage. Here are the steps to take when filing a claim:

- Assess the damage: Inspect the damage and take detailed photos and videos as evidence.

- Determine who is at fault: Identify what or who caused the damage. Was it you, a third party or natural elements?

- Review your policy: Check your insurance policy to understand what is covered and determine if any deductibles apply.

- Contact your insurance provider: Notify your insurance company immediately and ask what documentation is required.

- Gather documentation: Collect all the necessary documentation, including your insurance policy, third-party insurance information, photos of the damage and repair estimates.

- Submit the claim: Your insurer will provide you with a claims form, which you must fill out and attach all the required documentation to.

- Schedule an inspection: An adjuster might be sent out to inspect the damage and assess the claim — this step is not always applicable.

- Follow up and maintain contact: Keep in contact with your insurer to track the progress and state of your claim.

- Repair and reimbursement: Once approved, have your garage door repaired by a reputable company.

The entire process can take a few weeks, depending on the complexity of the claim and the insurer’s responsiveness. It might be worth seeing if you can repair the damage and then receive a reimbursement.

Consult Your Insurance Provider and Speak to Continental Door, Co. About Our Garage Services

As a homeowner, it is essential to know what type of coverage you currently have and whether you need to change or upgrade your policy to ensure your garage door is covered. You can contact your insurance provider to find the best way forward for your needs.

When you need 24/7 emergency garage door repairs or any other residential garage door products and services, Continental Door is here to help. We have been serving residents of the greater Spokane and north Idaho areas since 2000 and continue to provide value-added services, such as free estimates and quotes.

When you’re looking for a responsive repair team or wish to install a new garage door, get in touch with us online, and we’ll see that you are helped without delay.